31 | Add to Reading ListSource URL: abetterway.speaker.gov- Date: 2017-03-24 13:52:15

|

|---|

32 | Add to Reading ListSource URL: www.marioncad.org- Date: 2018-02-06 11:19:55

|

|---|

33 | Add to Reading ListSource URL: www.willacycad.org- Date: 2017-05-10 13:50:46

|

|---|

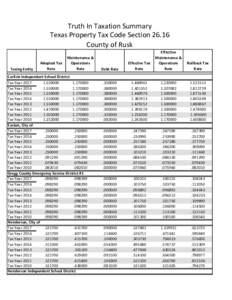

34 | Add to Reading ListSource URL: ruskcountytax.com- Date: 2017-09-29 12:26:20

|

|---|

35 | Add to Reading ListSource URL: www.ruskcad.org- Date: 2017-01-09 10:47:00

|

|---|

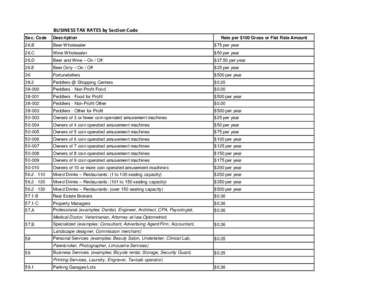

36 | Add to Reading ListSource URL: ruskcountytax.com- Date: 2017-09-29 12:25:51

|

|---|

37 | Add to Reading ListSource URL: d2oc0ihd6a5bt.cloudfront.net- Date: 2015-12-02 16:44:38

|

|---|

38 | Add to Reading ListSource URL: arlingtonva.s3.dualstack.us-east-1.amazonaws.com- Date: 2017-01-04 13:17:14

|

|---|

39 | Add to Reading ListSource URL: arlingtonva.s3.amazonaws.com- Date: 2014-01-13 11:33:33

|

|---|

40 | Add to Reading ListSource URL: arlingtonva.s3.amazonaws.com- Date: 2014-01-13 11:34:19

|

|---|